FedEx Freight Spinoff Forces Multi-Tenant Carrier Integration Redesign: The June 2026 Technical Debt Crisis

The FedEx Freight spinoff scheduled for June 1, 2026 presents an unprecedented challenge for multi-tenant carrier integration architectures. With 90,000 shipments per day, 350+ service centers, and nearly $9 billion in annual revenue, this separation forces a fundamental redesign of how TMS vendors handle carrier connectivity at scale.

Most middleware providers built their platforms assuming bundled carrier relationships would persist. Now they face the reality that bundled pricing arrangements combining parcel and freight services will split into separate agreements, creating dual API connectivity requirements where none existed before.

The Contract Unbundling Technical Debt Crisis

While smaller customers often use bundled contracts combining parcel and freight services under one agreement, the spinoff eliminates this simplicity. The challenge isn't just contractual. FedEx plans to spend $600 million enhancing IT infrastructure ahead of the spinoff, but this investment doesn't solve the problems facing their integration partners.

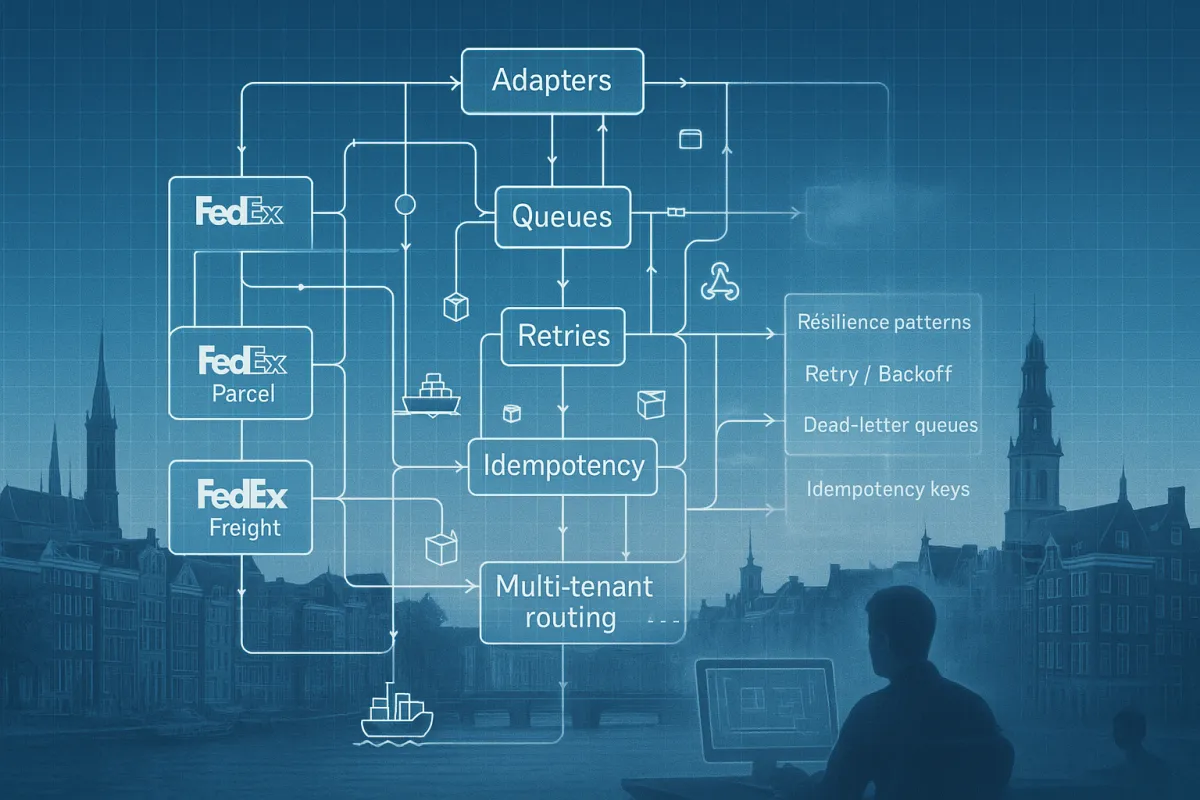

Multi-tenant platforms like nShift, EasyPost, ShipEngine, and Cargoson now must architect dual connectivity paths. The existing single API endpoint that handled both parcel and LTL routing must become two independent systems, each with separate authentication, rate shopping, and tracking capabilities.

Contract bifurcation means separate RFP cycles for parcel and LTL, fewer cross-service incentives, new dedicated freight sales teams, and transitional issues with IT and billing systems. For middleware handling thousands of customer configurations, this represents a massive data migration and system reconfiguration challenge.

Why Single-Tenant API Patterns Break Under Multi-Tenant Load

The research from Carrier Integrations Lab shows API downtime surged 60% between Q1 2024-2025, with 72% of carrier integrations facing reliability issues within their first production month. Integration bugs cost organizations an average of $8.2 million annually.

Multi-tenant architectures face a specific vulnerability: excessive load from one customer can degrade performance for the entire platform. When a large shipper suddenly needs to split their FedEx integration into separate parcel and freight connections, the resulting API calls can overwhelm rate limiting quotas and cause cascading failures.

Traditional single-tenant patterns assume dedicated resources per customer. But platforms serving hundreds or thousands of shippers through shared API connections to carriers must implement tenant isolation at the application layer, not just the infrastructure layer.

Resource Contention at Scale

Consider a middleware platform serving 500 shippers, each making an average of 100 rate shopping calls per day to FedEx. That's 50,000 daily API calls through a shared connection. When the spinoff forces dual connectivity, this becomes 100,000 calls across two separate carrier endpoints with potentially different rate limits and availability windows.

Without proper tenant isolation, a single customer running a rate shopping batch job could consume the entire API quota, leaving other tenants unable to process shipments. The FedEx spinoff amplifies this risk by doubling the API surface area where such failures can occur.

Multi-Tenant Rate Limiting and Circuit Breaker Patterns

The solution requires implementing tenant-aware rate limiting using API gateway usage plans. Each tenant gets assigned a unique identifier that acts as a custom API key, enabling per-tenant throttling policies. For FedEx freight spinoff integration, this means separate throttling policies for parcel and LTL APIs per tenant.

Data isolation becomes critical when serving multiple tenants through shared carrier connections. Tenant identifiers must be embedded at every layer of the system, from API routing to data storage. Access controls must prevent tenant A from accidentally accessing tenant B's shipment data, even when both use the same carrier endpoints.

Circuit breaker patterns prevent cascading failures across tenants. When FedEx Freight API calls start failing for one tenant, the circuit breaker should isolate those failures without affecting parcel API connectivity for other tenants. This requires implementing separate circuit breakers per tenant per carrier per service type.

Implementation Architecture

Modern platforms like Manhattan Active, Blue Yonder, and Cargoson implement this through distributed rate limiting using Redis or similar caching layers. Each API request checks the tenant's current usage against their allocated quota before forwarding to the carrier. Failed requests increment separate failure counters that trigger circuit breakers when thresholds are exceeded.

Queue-based processing becomes essential for handling spiky traffic patterns. Rather than making synchronous carrier API calls, requests get queued with tenant affinity, allowing the system to process them at sustainable rates while maintaining isolation.

The Hidden Integration Cost Reality

API integration costs typically range from $2,000 to $100,000+ for complex enterprise systems, with advanced integrations costing $50,000-$150,000. The FedEx spinoff effectively doubles these costs for any platform that previously treated FedEx as a single integration point.

Hidden costs emerge beyond the obvious dual API development work. Customer support complexity increases when troubleshooting requires investigating both parcel and freight connectivity for the same customer. Monitoring and alerting systems need updates to handle twice as many carrier endpoints per customer.

Contract testing becomes essential but expensive. Reducing debugging costs by 70% sounds attractive until you realize you now need separate contract tests for parcel and freight APIs. The maintenance burden grows exponentially with customer count.

Enterprise Platform Impact

Oracle TM, SAP TM, 3Gtms, and Cargoson customers face similar challenges. Their existing FedEx connector configurations must be duplicated and modified for the new freight entity. Custom mapping logic, exception handling, and business rules all need updating.

The platforms with the strongest multi-tenant architectures will handle this transition most gracefully. Those with tightly coupled, single-tenant designs will struggle with the additional complexity and resource requirements.

Preparing for the June 2026 Deadline

Multi-tenant architecture requires careful design for data isolation, security, and scalability. The FedEx spinoff forces this design to evolve rapidly. FedEx has confirmed existing contracts will be honored through current terms, with most freight agreements renewing annually.

This gives middleware providers roughly 18 months to implement dual connectivity. The platforms that start architectural work immediately will have competitive advantages. Those waiting until customer pressure mounts will face rushed implementations and higher technical debt.

Recommended patterns include implementing tenant-aware API gateways, separate connection pools per carrier per tenant, and queue-based processing with tenant affinity. Database schema updates should include tenant identifiers in all carrier-related tables.

Testing and Validation Strategies

Contract testing frameworks must validate both parcel and freight API responses independently. Integration testing requires scenarios covering the transition period when customers might have mixed connectivity states.

Load testing becomes critical for multi-tenant scenarios. Simulating realistic tenant distribution patterns helps identify resource contention issues before production deployment.

Post-Spinoff Carrier Landscape Changes

The competitive response will reshape the entire LTL market. Old Dominion, XPO, and regional carriers are already adjusting pricing strategies to capitalize on disruption from the FedEx separation.

Multi-carrier routing resilience patterns become more important when the largest LTL provider undergoes organizational changes. Platforms like Alpega, FreightPOP, E2open/BluJay, and Cargoson need failover logic that can route freight shipments to alternative carriers when FedEx Freight experiences transition-related service disruptions.

Long-term implications extend beyond API connectivity. The spinoff creates two companies with potentially different technology roadmaps, API versioning schedules, and integration support policies. Middleware providers must plan for divergent carrier relationships where unified approaches previously sufficed.

The shipper platforms best prepared for this transition will implement flexible multi-tenant architectures with strong tenant isolation, comprehensive rate limiting, and robust circuit breaker patterns. Those that don't will face technical debt, customer churn, and competitive disadvantage as the freight industry's largest player completes its historic separation.